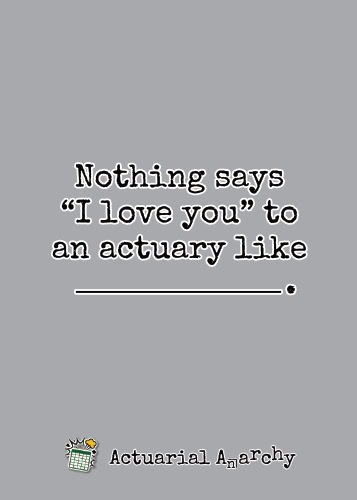

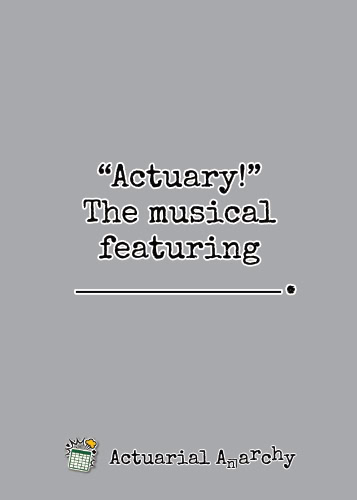

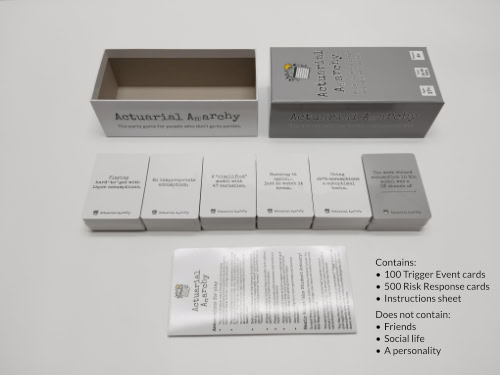

Actuarial Anarchy – The Card Game

The party game for people who don’t go to parties.

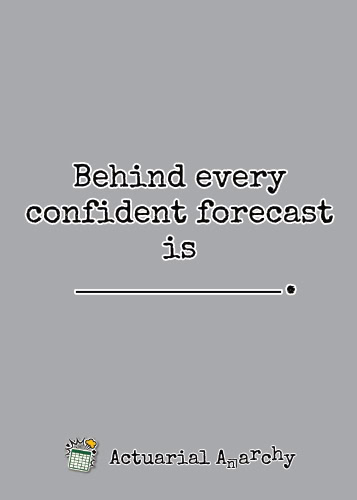

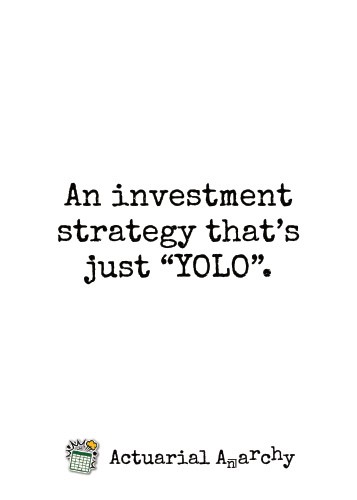

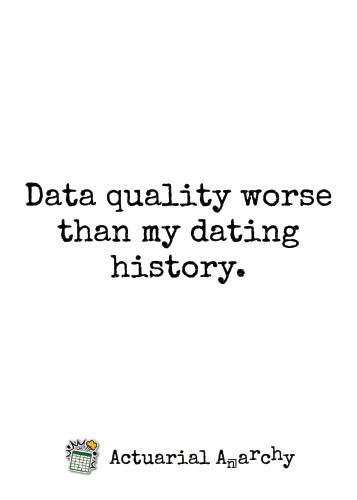

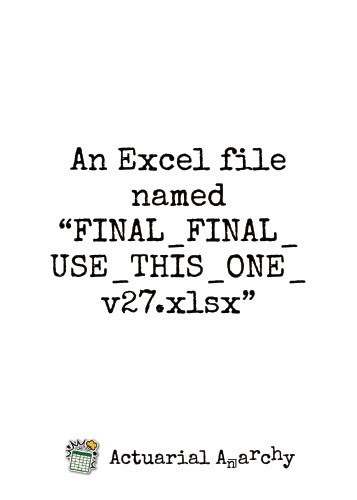

Actuarial Anarchy is fill-in-the-blank* card game for actuaries, underwriters, risk managers and all those daft brave enough to work in finance, pensions, or insurance.

The game is simple enough even for accountants to understand:

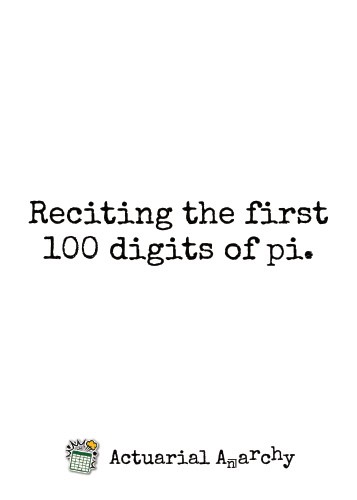

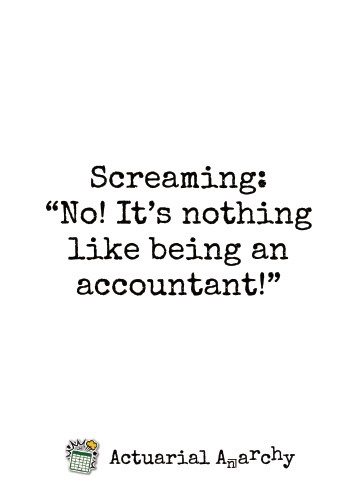

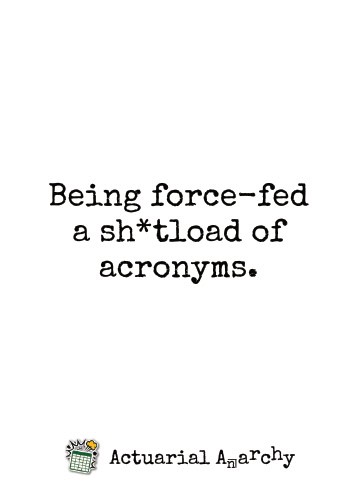

The Peer Reviewer reads out a grey Trigger Event card, and everyone else (the Junior Humour Analysts) submits their funniest Risk Response card.

*We’d mention that it’s like Cards Against Humanity, but their lawyers take a dim view of using their brand name advertising another game.

The Actuarial Profession

“I wish I was immunised against this!”

Frank Redington

"I laughed so hard, I nearly updated my assumptions."

"Actuaries, are they like accountants?"

Betty from Grimsby

"Finally, a game that makes pensions seem interesting!"

"I wish I still had the personality to have fun..."

Qualified Actuary

Pricing

Direct bank transfer

- £25 pick up from John at teaching venue

- £25 + £5 P&P EVRi signed delivery to UK address

John’s Payhip shop

- £27 + £5 P&P EVRi signed delivery to UK address

Number of copies remaining:

(last updated 25 January 2025)

Actuarial Anarchy instructions

Assumptions for play

- You have three or more friends (or more likely colleagues who have some spare time while they’re waiting for Excel to finish running a simulation).

- You have carried out a full risk assessment of the cards in the game to ensure that they are suitable for these “friends”. Alternatively, you have an unhealthy risk appetite (or have consumed copious amounts of alcohol/energy drinks/caffeinated drinks to bypass a healthy one).

- Everyone understands that humour is subjective and not quantifiable or measurable. And if you’re American, you should understand that “humour” should be read as “humor”.

- At least one player knows how to shuffle cards without performing a full stochastic simulation.

- Players can stay awake when actuaries read cards out loud in their dull monotone.

- All participants have at least a vague understanding of what an actuary does, how pensions and insurance work and a deep and abiding love for Excel.

- Any loss of dignity is non-reportable and assumed immaterial.

Basic Rules (aka Student Actuary)

To start the game, each Junior Humour Analyst (“player” for the non-actuaries amongst you) takes ten white humorous Risk Response cards.

The person who most recently had to explain what an actuary is (or failing that, the person who most looks like a stereotypical actuary) begins as the Peer Reviewer.

The Peer Reviewer draws an actuarial grey™ Trigger Event card and reads the fill-in-the-blank phrase out loud. Everyone else submits one white humorous Risk Response card, face down, to the Peer Reviewer.

The Peer Reviewer then shuffles all the white cards and re-reads the Trigger Event card out loud with each humorous Risk Response. Finally, the Peer Reviewer selects the funniest combination, and whoever submitted it wins a Personality Point. The winner keeps the grey Trigger Event card.

A bonus personality point is also awarded if they caused someone to laugh-snort or spit out their drink.

After the round, the next analyst to the left becomes the new Peer Reviewer and everyone draws a replacement white humorous Risk Response card.

The game ends when:

- The allotted time for this humour study expires.

- A Junior Humour Analyst acquires seven Personality Points.

- The amount of small talk generated by this game makes the majority of actuaries uncomfortable.

The winner is the analyst with the most Personality Points. If there’s a tie: flip a coin. If someone insists on simulating that with a stochastic model, they win by default.

Instructions for accountants and underwriters

Just do what the actuary tells you to do.

Intermediate Rules (aka Associate Actuary)

Actuaries wouldn’t be actuaries without some attempt to ruin a joke with technical accuracy. After the winning card is chosen, but before the grey card is awarded, an analyst may shout “Actually…” to challenge it on actuarial grounds.

The first player to do so may then justify their pedantry by citing any technical inaccuracies, statistical impossibilities, logical inconsistencies or misuse of terminology in the winning response. If an appeals panel of at least two other players agrees it’s a valid (and entertainingly petty) critique, then the challenger earns one Actuarial Point. The winner keeps the white Risk Response card.

However, if the objection is not upheld, the interjector loses one Actuarial Point, or if they have none, they lose one Personality Point. If they have no points to lose, they must miss their next turn while they contemplate whether this is why they have no friends.

A bonus Actuarial Point is also awarded if the correction sparks an actual discussion about mortality assumptions or any other actuarial topic.

A player cannot win the game by having the most Actuarial Points, but they do get the satisfaction of feeling professionally superior.

Should the same player have the most of both Personality and Actuarial Points, they are crowned the Chief Risk Officer of Banter and should never be let near a client unsupervised ever again.

Advanced Rules (aka Fellow Actuary)

Analysts may add any additional “house” rules to the game by common agreement, or by dictate from the Chief Actuary.

These can be from the list below or, if the actuarial exams haven’t robbed you of your imagination, you could make up your own.

“Fellowship”

Any player who accumulates the maximum of three Actuarial Points, they may declare themselves a Fellow of the Game. They can now read Trigger Event cards and their Risk Response in a deadly serious monotone. This continues until the player accidentally laughs, smiles or shows any hint of personality whatsoever.

“Sorry, I appear to be an accountant”

At any time, a junior analyst may discard any risk response card that they don’t understand and draw a new one. However, they must publicly admit their lack of understanding, and be mocked thereafter as an accountant.

“Risk mitigation”

A player may spend one of their points to discard and redraw as many risk response cards as they like. Handy if your humour portfolio is under-performing. Also useful for risqué aversion if you’re playing with your boss or client.

“Regulatory audit”

After the winning response is chosen by the Peer Reviewer, a player may spend a point and demand a regulatory audit, where the winning card is decided by all the analysts voting.

Model uncertainty

If the Peer Reviewer cannot choose between two hilarious risk response cards, they may award ½ point to each junior analyst.

Credibility Cap

To prevent a pedantry death spiral, no player may be awarded more than 3 Actuarial Points during a game. Any further objections they may have should be logged privately in their Continuing Pedantry Documentation (CPD) but will not be rewarded nor listened to.

Solvency Stress Test

Before reading the trigger event card, the Peer Reviewer may declare a solvency stress test and choose the stress conditions for play that round. Examples include “all cards must be read in a Scottish accent”, or “everyone pseudo-randomly chooses the card for the analyst to their left”, “everyone must play their worst card”. “the winner is selected randomly.” Each player may only declare one such stress test per game.

Risk pooling

For any round, two analysts may form a “risk pool” by jointly submitting their 2 responses. If either wins, they split the point. If both lose, they split the shame.

Reinsurance treaty

After the trigger event is read, an analyst may spend a point to enact a quota share treaty with another analyst. They can cede their least funny response card for a card chosen randomly from the other analyst. No retrocession allowed.

Captive reinsurance treaty

Before the trigger event is read, an analyst may spend a point to risk transfer one card to another player of their choice. That player must play it in the next round, no matter what. The original analyst replaces the card by drawing one from the pile.

Hedging

A player may spend a point to hedge their next risk response by submitting two cards. If the player wins, they get the point back (the hedge paid off). If not, they don’t.

Black Swan event

At any time any player can shout “market crash” and everyone passes their hand to the left. Only one such event occurs during any game.

Catastrophe bond

If any one analyst wins three rounds in a row, the others may trigger a cat bond event, and each submit two cards the next round.

Monte Carlo Madness

Once per game, any analyst may randomly pick a risk response to play. If they win, they get two points – because you never know.

Capital Injection

If any analyst has not won a round in 5 turns, they may call for a capital injection and draw 2 extra risk response cards.

Alternative risk transfer

Players may use blank cards to write a custom new cutting-edge risk response to any trigger event.

Disclaimers

- Playing Actuarial Anarchy does not count toward your annual CPD hours. Even if you really learned something dark from Alex in the claims department.

- This game contains an actuarial approximation to humour. Side effects may include nausea, disorientation and, should laughter occur, breach of the actuaries’ code of conduct.

- Results may vary from the 25,000 simulations we tried. Inferring the quality of the remaining 95% of possibilities seemed like a good idea at the time.

- The creators of this game accept no liability for reputational damage, broken friendships, or ensuing regulatory investigations.

- Not suitable for use in pricing, reserving, professional exams, or explaining to the public what actuaries do.

- This game does not constitute financial advice. Or professional advice. Or good advice.

- Statements made during gameplay should not be used in peer review, client presentations, or court.

- Any resemblance to real people, events, or assumptions, past or present, is purely coincidental. Remember, correlation is not causation. At least, that’s what we told the regulator.

- No actuarial models were harmed in the making of this game.

Acknowledgements

As always, I am indebted to those who risk their sense of humour by exposing themselves to my unrefined comedy.

My fellow tutors who tried out the very first version at that fateful Tutors Meeting in April 2025 and then my reviewers: Shang Xu, Greg Solomon, David Yardley, Emma Wang, Alvin Kissoon, Raquel Stokes, Dave Johnson, Adam Biroš and Akash Malpani.

Feedback

If you have any suggestions for new cards, new “house rules” or otherwise, then you can contact John Lee here.

After a suitable peer review, these suggestions will published on this page. They’ll also go in future versions of the game, if John can ever face taking such a stupid financial risk again to print another bunch…